My clients and friends keep asking me if the market is slowing down.

The answer is...yes and no.

Being a regional company with offices from the Portland area to a Bellingham is great because we get regional market updates that help us anticipate market shifts.

In this morning’s meeting, our CEO, Mike Grady, said, “We are still a long way from being a balanced market. We are still leaning towards being a seller's market over a buyer's market.”

Coldwell Banker Bain CEO Mike Grady in Bellevue on the big screen at a sales meeting in Bellingham.

What does a “balanced market” mean exactly?

A balanced market is one that doesn’t favor buyers or sellers, and has about 5-6 months of inventory.

Across the NWMLS, we had 1.9 months of inventory in June, and it was up to 2.9 months by September. By the end of the year we anticipate 3.5 months of inventory. So... inventory is creeping up giving buyers more options.

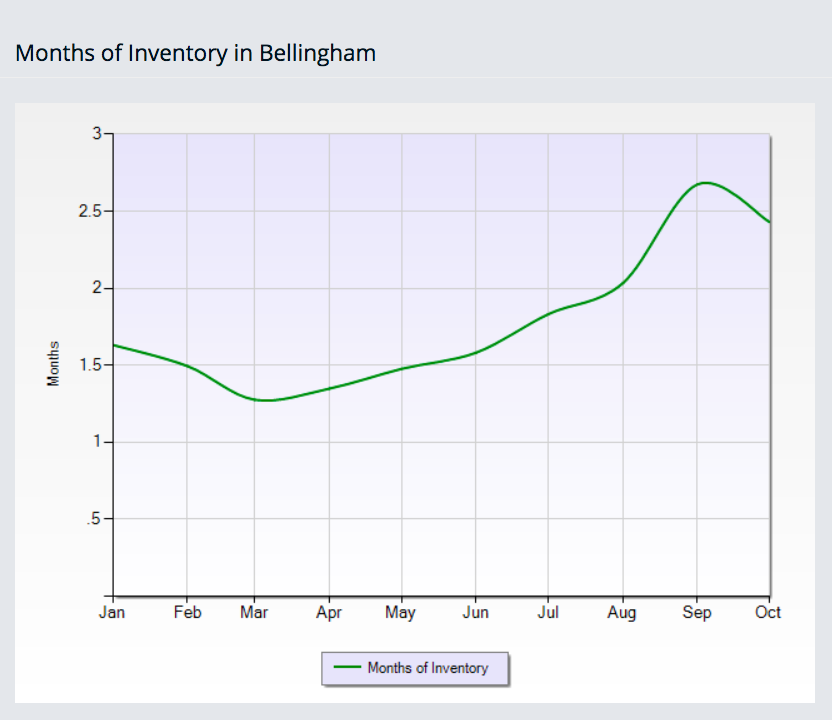

In Bellingham, our inventory has been inching up slightly throughout the year—but the key word is slightly. We’re still well below the 5 or 6 months mark that a balanced market requires.

I’m personally competing against fewer offers when representing buyers lately. But I’m not sure we’re headed for a significant market correction.

Why? A big influencer is that the economy is still strong. Washington state is adding about 10,000 jobs per month. And only 3,000-4,000 building permits are being issued per month. The demand for housing is still there.

However, interest rates are ticking up, currently sitting right around 5%. There is no real way of knowing exactly what rates will do, but most lenders expect about a 3 rate increase over the next year. That could mean a rate of 5.5%, some say 5.75%, in 2019. Rising interest rates definitely reduce buying power so it it will be interesting to see how that impacts the market.

So, will it be as hot of a market as early 2018? Probably not. Will it drastically change? Probably not. According to Grady, “In Portland and Seattle and the entire I-5 corridor, we anticipate that it will be mostly the same kind of market through the end of 2018 and throughout 2019. Right now there’s no logical reason to believe we won’t lean more towards a seller's market for the next 18 months or so.”